In the realm of cryptocurrency, a fundamental aspect that every user encounters is the crypto wallet. Much like a traditional wallet for physical currencies, a crypto wallet serves as a digital repository for managing and storing your digital assets. However, in the digital world of cryptocurrencies, these wallets go beyond a mere storage facility. They play a pivotal role in facilitating transactions, providing security measures, and granting users control over their private keys.

A crypto wallet, at its core, is a software or hardware tool that enables users to interact with their digital currencies securely. It manages cryptographic keys, allowing users to send, receive, and store various cryptocurrencies such as Bitcoin, Ethereum, and countless others. To embark on a journey within the crypto space, understanding the types, functionalities, and security measures associated with crypto wallets becomes paramount. In this exploration, users gain not only control over their financial assets but also a deeper insight into the decentralized and empowering nature of the cryptocurrency ecosystem.

How to store crypto safely

Here are crucial tips and recommendations to ensure the secure storage of your cryptocurrency without mentioning specific brands or products.

- Understand the Risks of Exchange Storage: Leaving your cryptocurrency on exchanges exposes you to potential risks, as witnessed in past incidents. While exchanges provide convenience for trading, they are susceptible to security breaches. Consider using exchanges solely for transactions and transfer your assets to secure wallets for storage.

- Prioritize Hardware Wallets: Hardware wallets are physical devices designed explicitly for storing private keys offline. These wallets provide an added layer of security, as they are less susceptible to online threats like hacking. Invest in a reputable hardware wallet for long-term storage of significant amounts of cryptocurrency.

- Diversify Your Wallets: Spreading your cryptocurrency holdings across multiple wallets adds an extra layer of security. Consider using a combination of hardware, software, and mobile wallets for different purposes. This diversification minimizes risks associated with a single point of failure.

- Secure Your Seed Phrases: Seed phrases are your ultimate key to accessing your cryptocurrency. Treat them with the utmost care and never store them online or in easily accessible locations. Consider using metal seed cards or other physical methods to store seed phrases securely, protecting them from potential loss or theft.

- Regularly Update Wallet Software: Keep your wallet software up to date to benefit from the latest security enhancements and bug fixes. Developers often release updates to address vulnerabilities, ensuring that your wallet remains resilient against evolving threats.

- Educate Yourself: Stay informed about the latest developments in crypto security. Regularly educate yourself on best practices, emerging threats, and new features introduced by wallet providers. Understanding the evolving landscape helps you make informed decisions to secure your assets.

- Implement Two-Factor Authentication (2FA): Where applicable, enable two-factor authentication for an additional layer of security. This adds an extra step to the authentication process, making it more challenging for unauthorized individuals to access your wallet.

- Test Small Transactions First: When using a new wallet or making significant changes, consider testing with small transactions before transferring larger amounts. This approach allows you to ensure that the wallet functions as expected and provides an opportunity to identify any potential issues.

- Regularly Backup Your Wallet: Create regular backups of your wallet data, including private keys and seed phrases. Store these backups in secure, offline locations, and periodically verify their accessibility. Having up-to-date backups is crucial in case of unforeseen circumstances.

By incorporating these tips into your cryptocurrency storage strategy, you can significantly enhance the security of your digital assets. Remember, the crypto landscape is dynamic, and staying vigilant is key to adapting to new challenges and ensuring the safety of your investments.

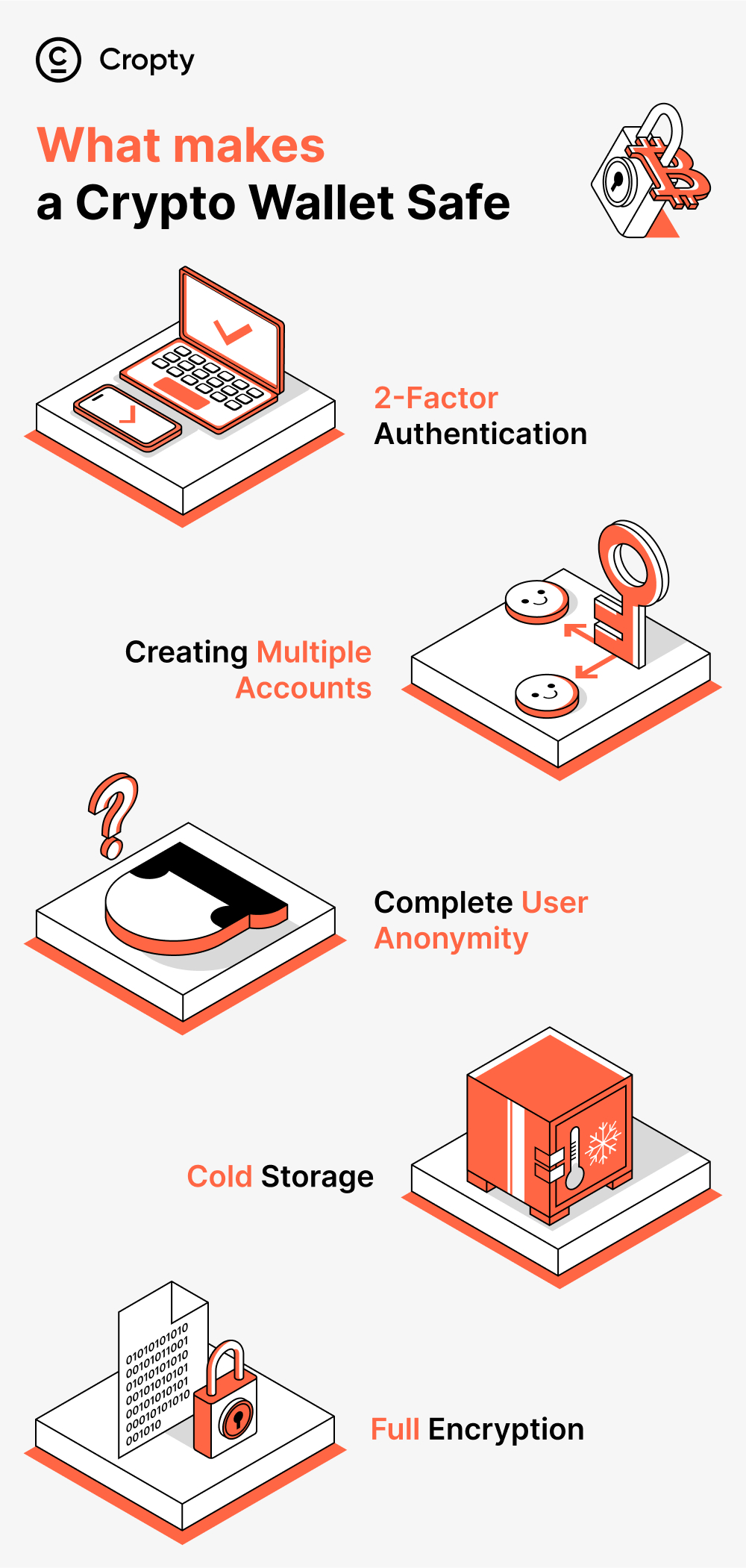

What makes a crypto wallet safe

Ensuring the security of a crypto wallet involves implementing several key features that safeguard the user’s digital assets. Here are the factors that contribute to making a crypto wallet safe:

- 2-Factor Authentication: Employing 2-factor authentication adds an extra layer of protection to the wallet. This method requires users to provide two forms of identification before accessing their accounts, typically combining something they know (like a password) with something they possess (like a unique code sent to their mobile device). This makes it significantly more challenging for unauthorized individuals to gain access to the wallet.

- Creating Multiple Accounts: Some crypto wallets allow users to create multiple accounts or sub-wallets within the main wallet. By doing so, users can separate their assets and transactions, reducing the risk of losing all funds in case of a security breach or compromised account.

- Complete User Anonymity: Maintaining user anonymity is essential for privacy and security in the crypto world. A secure crypto wallet ensures that the user’s personal information is well-protected and not linked directly to their wallet address or transactions, making it harder for malicious actors to track or target individuals.

- Cold Storage: Cold storage involves keeping the majority of the crypto assets offline, away from internet connectivity. This method significantly reduces the risk of online attacks, such as hacking or phishing attempts, as the private keys controlling the funds are stored on hardware devices or paper wallets, disconnected from the internet.

- Full Encryption: A safe crypto wallet employs robust encryption protocols to protect sensitive data, including private keys and transaction details. Encryption ensures that even if unauthorized parties manage to access the wallet’s data, the information remains indecipherable and useless to them.

By combining these features, a crypto wallet can provide a secure environment for users to manage and store their digital assets, mitigating potential risks associated with cryptocurrency ownership. It is essential for crypto users to choose reputable wallet providers that prioritize safety and employ these protective measures.