What is a Cold Wallet and how it works

In the dynamic landscape of cryptocurrency storage, the choice between convenience and security is paramount. While storing cryptocurrencies on exchanges or financial apps offers ease of use, the narrative underscores the importance of considering cold wallets for enhanced security and control, especially when safeguarding substantial sums.

Cryptocurrency storage revolves around private keys and alphanumeric passwords linked to wallets. When acquiring cryptocurrencies like Bitcoin, they’re usually stored on the exchange where purchased, relying on the platform for key security. Financial apps like PayPal or Robinhood, though convenient, may limit transaction flexibility and key access. A digital wallet on a personal computer offers more control but carries hacking risks when online. For substantial sums, a cold wallet is the safest choice, storing keys on an isolated device, and providing added security features. This emphasizes the crucial decision of selecting a secure storage method in the complex world of cryptocurrency.

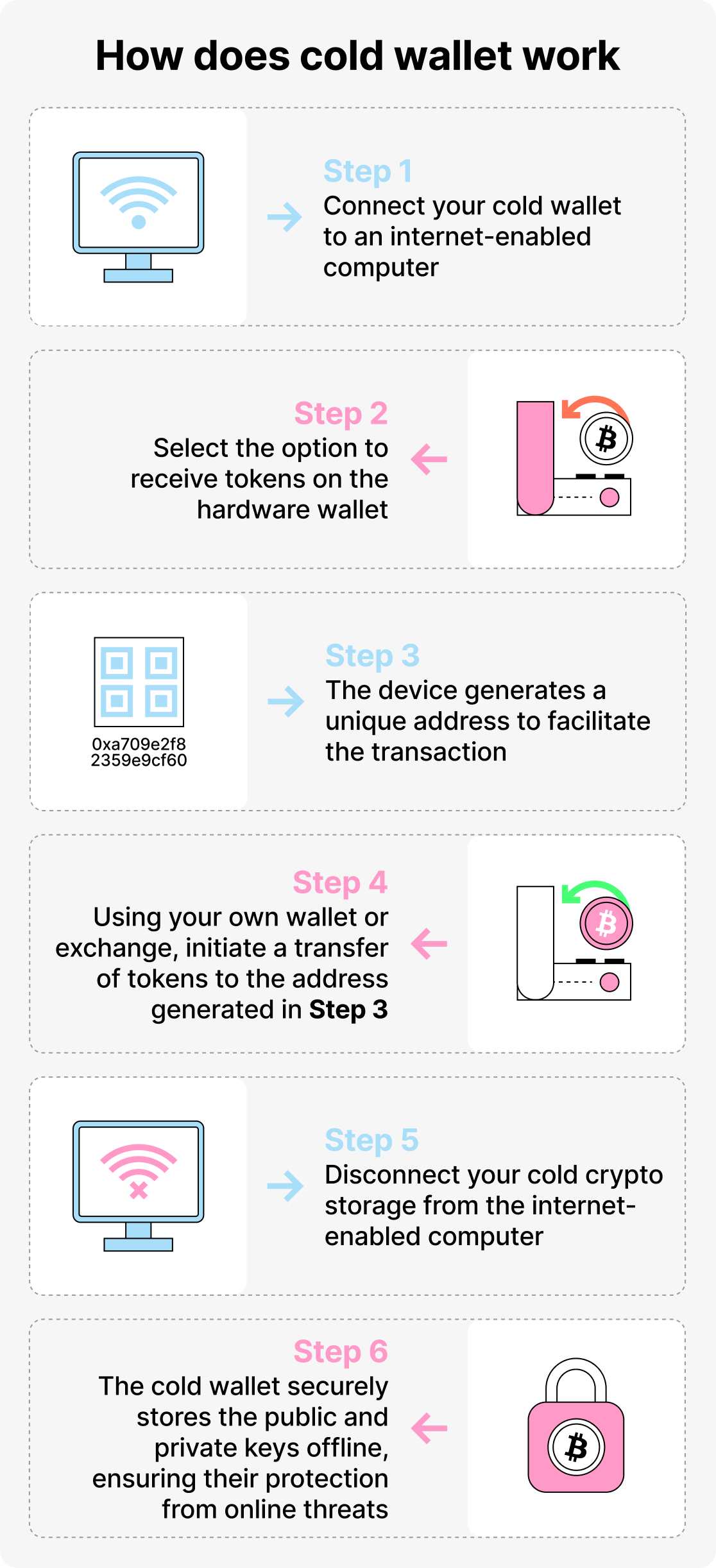

How Does a Cold Wallet Work

A cold wallet is a device that securely stores your private key, which is necessary to access and control your cryptocurrency assets. When you buy cryptocurrency, the transaction is recorded on a blockchain, a decentralized system accessible via the Internet. However, the private key required to access your assets needs to be protected from online threats.

To use a cold wallet, you connect it to an internet-enabled computer using USB or Bluetooth. The cold wallet has its own mobile or desktop app that you use to access your funds. The private key is stored securely on the cold wallet, which acts as a smart memory stick.

Can a Cold Wallet be Hacked (And how to Avoid it)

Cold wallets are highly unlikely to be hacked due to their offline nature and strong security measures. They keep private keys and sensitive information offline, minimizing exposure to cyber-attacks. However, it is still important to choose and use your cold wallet with caution to ensure that nobody can get access to your funds.

For example, a user purchased a hardware wallet from a third-party seller, and it turned out to be a faulty device. The user was prompted to go to a website that they believed to be the official Trezor website to set up the wallet, but it was likely a phishing website designed to steal their private keys and cryptocurrency.

To prevent such incidents, users must follow these essential security measures:

- Buy Directly from Manufacturer: Avoid purchasing hardware wallets from third-party sellers or untrusted sources. Always buy directly from the manufacturer’s official website to ensure you receive a genuine and uncompromised device.

- Verify Website URL: Double-check the website URL to ensure it is the official website of the hardware wallet manufacturer. Scammers often create fake websites with similar URLs to deceive users.

- Check Reviews and Reputation: Before making any purchase, check the reviews and reputation of the seller or website to ensure legitimacy and customer satisfaction.

- Avoid Sharing Private Keys: Never share your private keys with anyone or enter them on any website. Hardware wallets should not require you to enter your private keys online.

- Enable 2FA and PIN: Enable two-factor authentication (2FA) wherever possible, and set a strong PIN for your hardware wallet to add an extra layer of security.

- Keep Seed Phrase Secure: Write down your seed phrase on paper and store it in a secure, offline location. Never store it electronically or share it with anyone.

- Stay Informed: Keep yourself updated about the latest security practices and potential scams in the crypto space. Stay vigilant and cautious while dealing with your crypto assets.

Related: 14 Best Metal Crypto Wallets: Top Steel Seed Phrase Storage 2023

What Happens if You Lose a Cold Wallet

Losing a cold wallet can have significant implications, leading to the loss of access to your cryptocurrency funds. If you misplace or lose your cold wallet, it becomes challenging to retrieve your funds unless you have a backup of the recovery seed phrase or private key.

To prevent the permanent loss of your funds, it is crucial to always maintain a secure backup of your recovery seed phrase or private key. This backup should be stored separately from the physical cold wallet in a safe and secure location. Having a backup ensures that you still have a means of accessing your funds if the cold wallet is lost, damaged, or becomes inaccessible.

If you discover that you have lost your cold wallet, it is advisable to take immediate action. Transferring your cryptocurrency assets to another wallet or storage solution can help protect your funds from potential unauthorized access. By moving your assets to a new wallet, you mitigate the risk of permanent loss and ensure the security of your funds.

How to use a Cold Wallet

Here is a step-by-step guide on how to use a cold wallet:

- Understand the Private Key: The private key is like a password, a long string of numbers and letters, associated with your cryptocurrency wallet. It is essential for accessing and managing your coins.

- Acquire a Cold Wallet: Purchase a cold wallet device from a reputable provider like Trezor or Ledger. These devices are designed specifically for cryptocurrency storage and have extra protections built into their software.

- Set Up the Cold Wallet: When you set up the cold wallet device for the first time, it will provide you with a recovery seed, which consists of a bunch of random words. Write down the recovery seed and keep it in a safe place. This seed is crucial because it allows you to recover your coins if the wallet device is lost or broken.

- Use the Cold Wallet: When you want to access your cryptocurrency, you’ll need to plug the cold wallet device into your computer via USB and enter a PIN to unlock it. The private keys are stored securely on the device.

- Create Backup and Recovery: Always keep a backup of your recovery seed in a safe place separate from the cold wallet. In case the wallet is lost, stolen, or damaged, you can use the recovery seed to restore access to your funds.

Related: 10 Best Cold Wallets for Crypto Storage

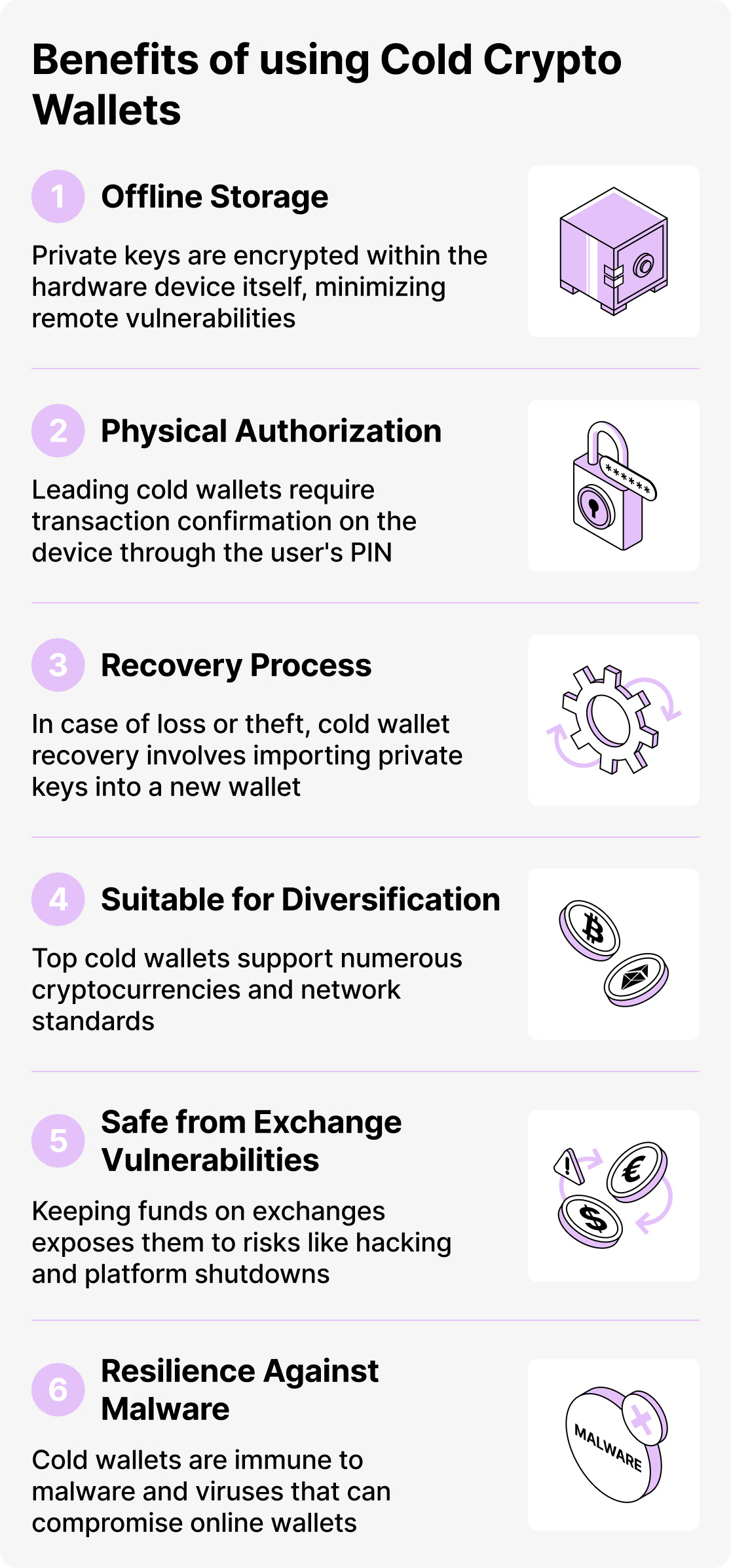

Reasons to use a Cold Wallet

Utilizing a cold wallet, specifically an air-gapped cold wallet, stands out as a prudent choice for individuals seeking to secure their cryptocurrency assets over the long term. Here are the key motives for adopting a cold wallet, drawing insights from the provided information:

- Unmatched Security: A cold wallet, particularly an air-gapped variant, represents the pinnacle of security within the cryptocurrency realm. This specialized wallet remains isolated from the internet, ensuring the safeguarding of private keys against unauthorized access and cyber threats. Importantly, it lacks any internet-facing components, rendering it highly resistant to hacking attempts.

- Ownership and Autonomy: In contrast to entrusting assets to an exchange, a cold wallet affords complete ownership of private keys. This ownership translates into full autonomy over cryptocurrency holdings, allowing users to retain control indefinitely without reliance on third-party services.

- Mitigating Exchange-Related Risks: Keeping assets on an exchange entails placing trust in the platform to protect those funds. Yet, vulnerabilities such as exchange issues, security breaches, or disruptions can jeopardize holdings. By employing a cold wallet, individuals insulate their assets from vulnerabilities associated with exchanges.

- Secured Transactions: Cold wallets facilitate secure transactions without exposing private keys to online threats. Users can securely authorize transactions and manage their assets with peace of mind.

- Long-Term Asset Preservation: Cold wallets serve as the preferred choice for safeguarding cryptocurrencies intended for long-term holding, devoid of frequent trading. They provide a robust solution for preserving assets over extended durations.

- Risk Diversification: Employing a diversified set of storage methods, including exchanges for active trading, hot wallets for smaller holdings, and cold wallets for significant assets, enables effective risk mitigation and asset protection.

- User-Friendly Interfaces: Some air-gapped cold wallets, like the one mentioned, incorporate user-friendly interfaces and touchscreen functionality, ensuring ease of use. This combination of convenience and security is highly advantageous.

- Private Key Confidentiality: Recognizing that private keys are the linchpin of cryptocurrency holdings, the use of an air-gapped cold wallet guarantees their confidentiality and shields them from potential intrusions. It is essential to securely store the recovery seed (backup) offline as well.

In conclusion, using a cold crypto wallet is essential for safeguarding your cryptocurrency assets and ensuring that you have control over them. It’s a proactive step toward financial security in the world of digital assets. As the crypto space continues to evolve, it’s crucial to prioritize the security and control of your holdings to avoid potential nightmares like the San Francisco man’s situation.