Bitcoin (BTC)

USD to BTC converter

Bitcoin (BTC) is the most popular cryptocurrency. It is the first example of a cryptocurrency, a form of decentralized digital money that is created and transferred electronically. In this article you can answer all your questions about Bitcoin, learn its history, future and much more.

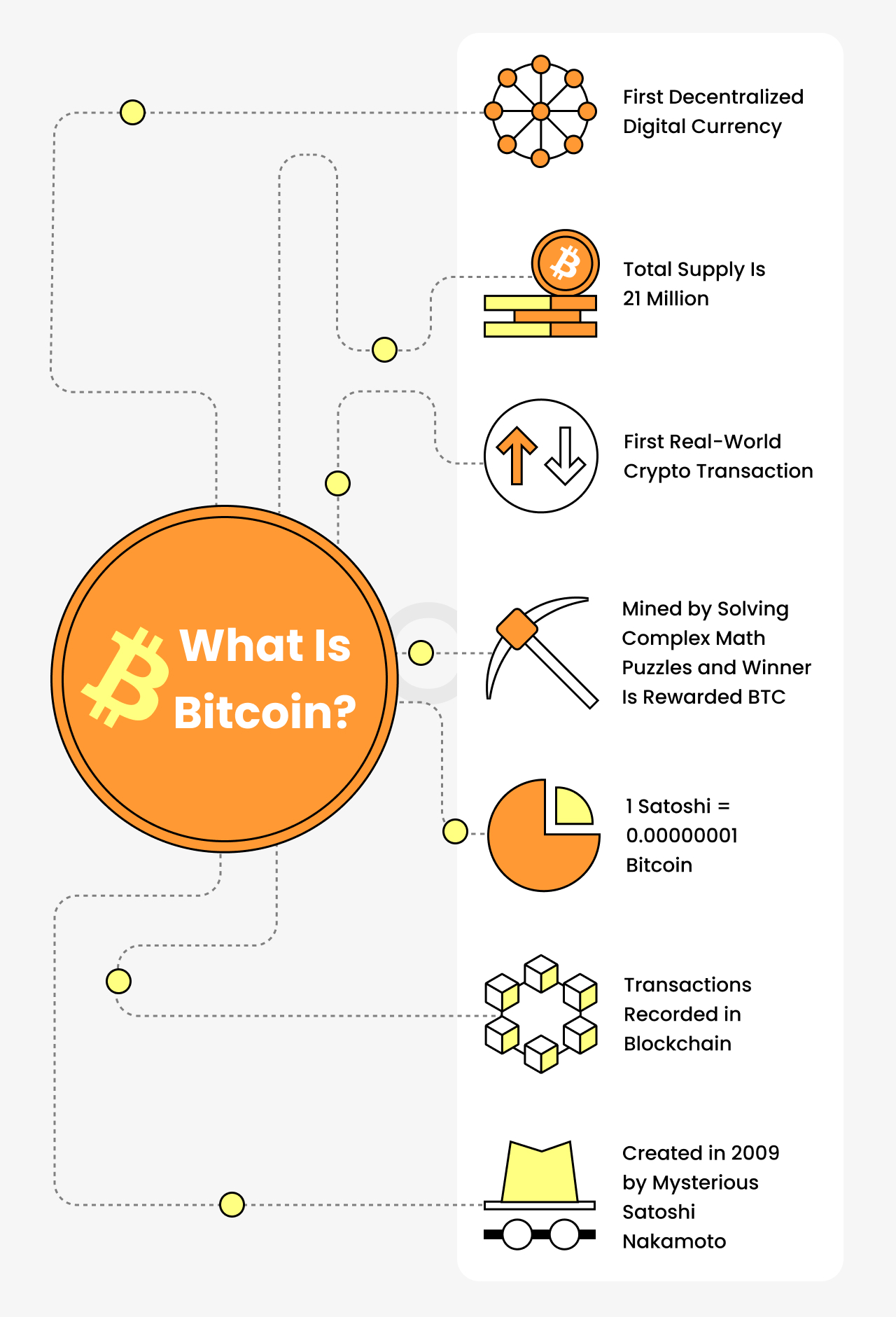

What Is Bitcoin (BTC)?

Bitcoin is known as a digital or virtual currency. It is a decentralized, peer-to-peer cryptocurrency system. It allows users to send and receive payments online without third parties as it is in a classic bank system. Nobody like a person, group, or government can control the payments, but everyone can buy Bitcoin and make a transaction.

Bitcoin also uses cryptography to secure and verify transactions as well as to control the creation of new units. Bitcoin can be used to purchase goods and services online, and is already accepted by various businesses and merchants all over the world.

What Is the Purpose of Bitcoin?

The concept of Bitcoin was first described in a technical document (whitepaper) published on October 31, 2008.

The purpose of creating Bitcoin was to provide a peer-to-peer electronic cash system. It enables to send online payments directly from one party to another without participating in a financial institution. So, Bitcoin is a decentralized digital currency without a central bank or single administrator, and transactions take place between users directly, without an intermediary.

What Is BTC Token?

BTC is a digital currency. It is a Bitcoin token that is stored in a digital wallet. You can buy goods and services using BTC, or exchange them for other digital currencies.

What Is the Difference Between Bitcoin and BTC Token?

The difference between Bitcoin and a BTC Token is that the last is a form of digital asset developed on a blockchain network, whereas Bitcoin is a decentralized digital cryptocurrency. With Bitcoin, users may store and transfer money without depending on a centralized institution like a bank. BTC Tokens are tokens that are created on a blockchain platform as a component of a project and a decentralized application. BTC Tokens may also be exchanged for other tokens, goods, or services.

History of Bitcoin

Bitcoin was first introduced in 2008 as a decentralized currency without the need for a central bank or any intermediaries by a mysterious creator known only as Satoshi Nakamoto.

In 2009, Bitcoin was first used after it was released as open-source software when Nakamoto mined the starting block of the blockchain. This is referred to as the Genesis Block, and it contained the first 50 Bitcoins ever created.

From there on, Bitcoin continued to be mined by other early contributors until 2010. That’s when programmer Laszlo Hanyecz made the first known commercial transaction using cryptocurrency through the purchase of two Papa John’s pizzas for 10,000 Bitcoins.

When Bitcoin started out there wasn’t really a price for it since no one was willing to buy it. The first time Bitcoin actually gained value was on October 12, 2009. Bitcoin first became available to buy, sell and trade on online exchanges in 2010. 5050 Bitcoins were sold by Martti Malmi, a Finnish Bitcoin developer working with Satoshi, for a total of $5.02 – setting the value of 1 Bitcoin at $0.0009. In April 2011, the price of Bitcoin crossed the $1 threshold.

Bitcoin’s price history has had its ups and downs, with some peaks and valleys along the way. In the early years, Bitcoin was seen as a mostly speculative tool, with its price soaring and falling dramatically. It was only in 2017 that Bitcoin began to gain mainstream acceptance as an alternative to traditional fiat currency. In 2017, Bitcoin’s price soared to new highs and its market capitalization grew to over $200 billion.

Today, there are hundreds of cryptocurrencies, but Bitcoin remains the most popular and valuable by far. It is used in a variety of ways, from buying goods and services to trading and investing. The success of Bitcoin has sparked the creation of many other cryptocurrencies, as well as a new industry of blockchain-based technologies.

Who Are the Owners of Bitcoin?

Today the amount of BTC addresses is more than 40 million. Some richest people in the world such as Michael Novogratz, Richard Branson, and others are the owners of Bitcoin as well as simple people. According to Bitinfocharts, there are more than 36,228,958 addresses richer than $1 and more than 5,010 addresses richer than $10,000,000.

The biggest balance of Bitcoin is 248,597 BTC as of the date of publication and this is 1,29% of all coins. Today it is $5,693,841,350, and this address is

34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo. The second richest Bitcoin address has 168,010 BTC which is 0,8% of all coins.

The 3rd and the 4th places are holding 127,351BTC and 124,347BTC which is almost $3,000,000,000 for every address.

Only these 4 addresses have more than 100,000 BTC.

Bitcoin Roadmap

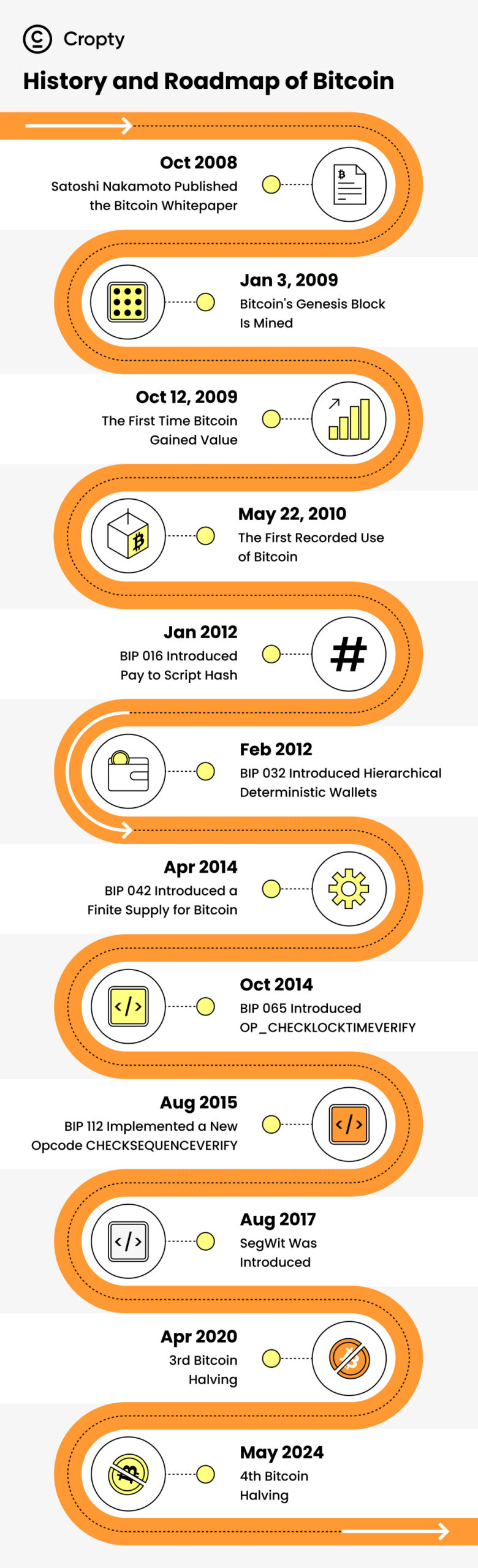

- Satoshi Nakamoto published the Bitcoin whitepaper in October 2008.

- Bitcoin’s genesis block is mined on January 2009.

- M-of-N-signatures necessary transactions were added as a new “standard” transaction type in October 2011 by BIP 011. Secured wallets, escrow transactions, and other use cases where more than one signature is required to redeem cash were made possible by this BIP.

- With the implementation of a new “standard” transaction type for the Bitcoin scripting system in January 2012, BIP 016 expanded on BIP 013, which introduced Pay to Script Hash address types, and set additional validation requirements that only apply to the new transactions. The BIP changed who was responsible for providing the requirements for a transaction to be redeemed, shifting them from the sender of funds to the redeemer. Additionally, it enabled a sender to fund any arbitrary transaction, regardless of how complex, using a fixed-length 20-byte hash that can be quickly copied and pasted or scanned via a QR code.

- Hierarchical Deterministic Wallets (also known as “HD Wallets”) were introduced in BIP 032 in February 2012. These wallets can be shared partially or wholly with several systems, each of which can spend coins or not. Multiple Bitcoin wallets (public-private key pairs) can be created using HD wallets using just one seed phrase.

- BIP 042 introduced a limited supply of Bitcoin in April 2014. Developers added a hard cap for Bitcoin after finding a problem that would have allowed its money supply to increase eternally and forever.

- A new opcode (OP CHECKLOCKTIMEVERIFY) for the Bitcoin scripting system was added in October 2014 by BIP 065, allowing a transaction output to be rendered unspendable until a later date. This was a crucial addition that made payment methods possible.

- Combined with BIP 68, the new opcode (CHECKSEQUENCEVERIFY) introduced by BIP 112 in August 2015 for the Bitcoin scripting system allows for the restriction of a script’s execution routes based on the age of the output being spent.

- This idea was put up as BIP 148, a Bitcoin Improvement Proposal, in August 2017 by a developer going by the nickname Shaolinfry. It was put up in opposition to a proposal known as “Segwit2x,” which was a deal reached by investors, corporations, developers, and miners to adopt SegWit (a soft fork) with a 2MB block size (hard fork). In order to show that they controlled the Bitcoin network, users launched a user-activated soft fork in response to this suggestion.

- A new structure known as a “witness” that is committed to blocks separately from the transaction Merkle tree was specified in BIP 141. This structure provides information that is necessary to confirm the legitimacy of a transaction but not to ascertain its effects. This new structure is where scripts and signatures are specifically transferred.

- In order to reduce unnecessary data hashing during verification and cover the input value by the signature, BIP 143 provides a new transaction digest method for version 0 witness programs. In order to remedy a malleability vector in the additional stack element used by OP CHECKMULTISIG and OP CHECKMULTISIGVERIFY, BIP 147 proposes adjustments to the Bitcoin transaction validity criteria. BIP 148 Activation of the segregated witness deployment, often known as “segwit,” on the defined soft fork flag day. BIP141, BIP143, and BIP147 were activated. Users had until August 1, 2017, to select whether or not to implement SegWit.

Bitcoin Halving

Bitcoin halving is an event in which the reward for mining new blocks is cut in half. This event takes place every four years, according to pre-set rules in Bitcoin’s code, and is designed to reduce inflation and control the issuance of new Bitcoins entering circulation. The goal of the Bitcoin halving is to make sure that the rate at which new coins are issued over time decreases, maintaining the value of each coin.

The first Bitcoin halving or Bitcoin split occurred in 2012 when the reward for mining a block was reduced from 50 to 25 BTC. The halving event in 2016 reduced incentives to 12.5 BTC for each block mined, and as of May 11, 2020, each new block mined only generates 6.25 new BTC.

Bitcoin halving is typically accompanied by a lot of turmoil for the cryptocurrency, as it reduces the supply of available Bitcoin and increases the value of Bitcoins yet to be mined. Additionally, halving provides miners with an incentive to continue mining as prices rise, but miners may lose the incentive to create more Bitcoin if the price of the digital currency does not rise and block rewards are reduced.

In 2024, the next Bitcoin halving is expected to take place. This system will continue until roughly 2140.

When Did Bitcoin Appear?

Bitcoin was invented in 2008 by Satoshi Nakamoto and the currency began to be used in 2009, when its implementation was released as open-source software. The Bitcoin blockchain was officially launched when the first Bitcoin block, the Genesis Block, was created on Jan. 3, 2009. The first recorded use of Bitcoin in the exchange of a good or service occurred on May 22, 2010 when Floridian programmer Laszlo Hanyecz offered to pay 10,000 BTC for a pizza.

Why Is Bitcoin So Popular?

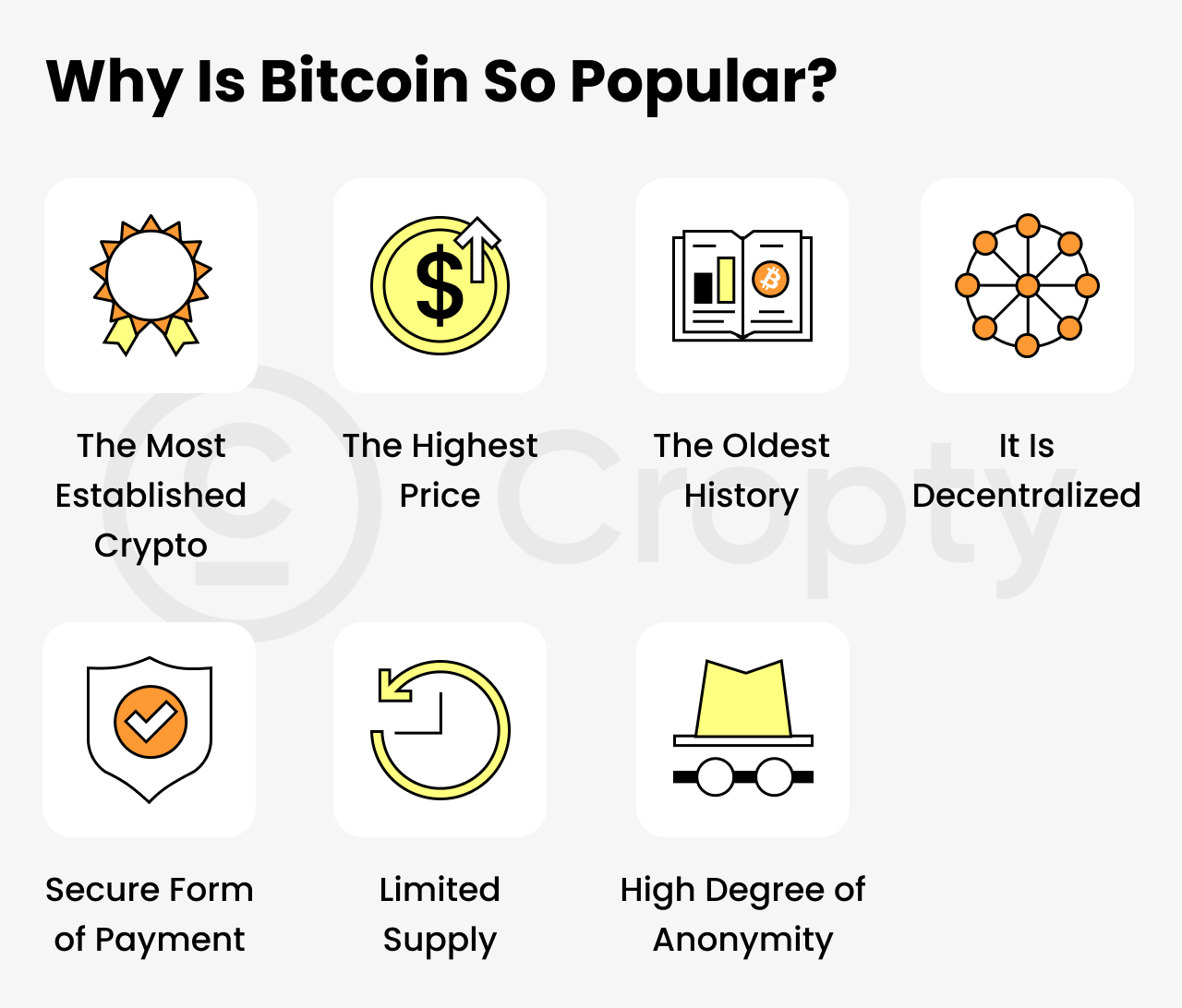

No one will argue that Bitcoin is the most popular crypto. Look at any chart and everywhere Bitcoin will be in the first place. Why is Bitcoin so popular? Bitcoin is popular because it is the most established and widely-traded form of cryptocurrency. What else?

- The highest price. Today 1 BTC costs $23,095.69 and there is no one such expensive crypto exists.

- The oldest history. Bitcoin is the first crypto in world history.

- It is decentralized. Meaning no government or institution controls it.

- Secure form of payment. That can be quickly and cheaply sent anywhere in the world.

- Limited supply. It is attractive to investors as a hedge against inflation.

- High degree of anonymity. It is attractive for users who wish to remain anonymous when making payments or storing wealth.

Bitcoin Communities

There are several online communities dedicated to Bitcoin, including the most popular such as:

- https://bitcointalk.org/,

- https://www.reddit.com/r/Bitcoin/,

- https://github.com/bitcoin/bitcoin.

Bitcoin Reviews

Some of the users say about Bitcoin that this is “the most secure and undervalued digital currency on the planet”. If you read reviews on the biggest exchanges, it is clear that people are happy that Bitcoin has finally started to grow and come out of hibernation. What do you think about Bitcoin? Share your opinion with us!

Bitcoin Support

Bitcoin is not a financial company, that is why there is no any central governing body or a kind of. However, there are many online forums, resources, and communities online dedicated to helping people with their Bitcoin-related questions and issues. Additionally, you can find companies that will provide you with technical support and services related to Bitcoin, such as wallets, exchanges, and more.

Bitcoin Chat

Will be available soon

How Long Does It Take to Transfer Bitcoin?

The average time for a BTC transfer on the Bitcoin network is about 10 minutes. However, transaction time can sometimes be longer because of network congestion or other factors. The exact amount of time required to transfer Bitcoin depends on the paid fees and the amount of miners processing the transactions.

Bitcoin Blockchain

Bitcoin runs on a blockchain. This is a system that can be compared to a big book containing all the records of what happens with cryptocurrency. It is a database that is a continuous chain of blocks, in each of which new transactions are recorded. And every Bitcoin owner has an independent but identical copy of this book on hand.

Every Bitcoin transaction takes place in the Bitcoin blockchain network, which is the online environment where hash power production and mining take place.

Bitcoin Explorers

- https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

- https://www.blockchain.com/explorer

- https://blockchair.com/bitcoin

- https://blockstream.info/

- https://live.blockcypher.com/btc/

- https://explorer.viawallet.com/btc

How to Mine Bitcoin

To produce a new block of transactions and add it to the blockchain, one must solve challenging mathematical riddles.

ASICs, a type of specialized hardware, and powerful computers carry out the Bitcoin mining operation. ASICs are made to address the proof-of-work conundrums that Bitcoin uses to validate transactions and add them to the blockchain.

Miners must first create a Bitcoin wallet in order to store their earnings before they can begin mining.

The next step for miners is to choose a mining pool. Mining pool is a collection of miners that pool their computer power to increase their chances of discovering new blocks and obtaining rewards. Miners can connect their ASICs or computers to the pool and start mining after choosing the mining pool.

Finally, miners can launch their mining program and start competing with other miners to crack the codes and earn Bitcoin as a reward. It is crucial to remember that mining performance varies and cannot be guaranteed because the process carries inherent risk.

How Much Energy Does It Take to Mine 1 BTC?

To mine 1 Bitcoin, different amounts of energy are needed. It depends on the mining equipment utilized. Generally speaking, mining Bitcoin uses more energy, the more powerful the hardware is. Application-Specific Integrated Circuits are the most power-hungry sort of mining equipment (ASIC). The amount of energy needed to mine 1 Bitcoin using an ASIC can be anything between 2,000 kWh and 13,000 kWh.

How Many BTC Coins Are There?

Bitcoin is designed in such a way that the maximum number of coins is 21 million. Approximately 2 million Bitcoins (BTC) will still need to be mined as of June 2022, which means that there are currently 19 million in circulation.

How Many BTC Coins Are Left?

On April 1, 2022, miners mined the 19 millionth Bitcoin. This means that only about 2 million BTC remain to be mined. Experts predict that the last BTC coins will be mined by 2140. When the total number of BTC coins reaches its limit of 21 million, no additional BTC coins will be generated and miners will earn income only from transaction fees.

Do You Pay Tax with Bitcoin?

There is still a great deal of uncertainty over Bitcoin’s taxation more than ten years after its launch. Although it was intended to be a resource for everyday transactions, cryptocurrency hasn’t yet taken off as a form of payment. In the meantime, it has gained popularity among traders and speculators trying to profit on its volatility.

The IRS treats Bitcoin and other “convertible virtual currencies” as property, more specifically a capital asset, rather than a currency. This means that every time Bitcoin is purchased, sold, or traded, there are tax repercussions. Although it might seem like a small distinction, it’s not. Similar to how owning and trading stocks or exchange-traded funds (ETFs) might result in capital gains taxes, it influences how Bitcoin is taxed.

Capital gains taxes are available in two types, short-term and long-term:

- Gains in the short term. A charge on gains made from the sale of Bitcoin for USD or other cryptocurrencies within a year of the transaction’s initial date. Your ordinary income tax rate is applied to short-term capital gains.

- Gains over the long term. A charge on earnings made from the sale of Bitcoin for dollars or other cryptocurrencies after holding it for more than a year. Based on your ordinary income tax rate, long-term capital gains are taxed at variable rates that can range from 0% to 20%.

Taxable actions do not simply happen when one sells Bitcoin. Bitcoin will be taxed at your usual income tax rate whether it was received in exchange for products and services, interest, staking, or mining. The Bitcoin’s worth on the day you got it determines how much income tax is owing. The fair market value of the Bitcoin on the day you received it is what’s used to calculate your taxable income. Less frequent occurrences like hard forks and airdrops will also result in a taxable event that will be taxed at your ordinary income tax rate.

Bitcoin Rank

Bitcoin is the first cryptocurrency on every exchange. Bitcoin’s market capitalization is $880 billion, that is the highest in the crypto world.

Bitcoin Stocks

Bitcoin stocks are a form of digital asset. Such companies as Tesla, Block, and others are among the public companies with the biggest Bitcoin holdings. Block has poured hundreds of millions of dollars into Bitcoin. Tesla purchased $1.5 billion worth of Bitcoin in early 2021. By February 2022, the electric vehicle maker reported that it held almost $2 billion of the cryptocurrency. MicroStrategy – a business intelligence software company – has been accumulating Bitcoin since 2020. It held $5.7 billion in cryptocurrency by the end of 2021 and said it plans to buy more with excess cash generated from operations. As opposed to traditional assets, Bitcoin stocks have lower volatility and offer high returns for investors.

There are several types of Bitcoin stocks available on the market:

- Bitcoin Exchange Traded Funds (ETFs)

- Bitcoin Futures

- Bitcoin Investment Trust (BIT)

- Grayscale Bitcoin Trust (GBTC)

- Bitcoin Mining Stocks

Bitcoin Tokenomics

The tokenomics of Bitcoin is clear and smart, with everything being visible and predictable. Bitcoin’s incentives maintain the network safe and motivate miners to process transactions.

The total supply of Bitcoin is pre-programmed and a block is mined roughly every 10 minutes, rewarding the miner 6.25 BTC.

For every 210K blocks, the reward is halved, which happens every 4 years. The current amount in circulation shows we are already at almost 90% of the total supply, with an annual issuance of around 328K BTC. So, simply divide the total number of minutes in the year by 10 (because a block is mined every 10 minutes), and then multiply the result by 6.25. (because each block gives out 6.25 BTC as a reward). As a result, it is possible to predict how many Bitcoins will be mined annually; the final Bitcoin is anticipated to be produced around 2140 year.

Transaction fees are used to pay the miners for adding new transaction into the next block. It is another aspect of Bitcoin’s tokenomics. This cost is intended to escalate as network congestion and transaction size do. While block subsidies continue to decrease, it aids in the prevention of spam transactions and encourages miners to continue validating transactions.

Simply saying, tokenomics means a token’s economics. Tokenomics includes the rules and incentives that govern how a token is created, distributed, and used in a network.

Bitcoin’s tokenomics is a model that has survived the test of time and is still relevant today.

How to Get BTC for Free? Bitcoin Airdrop

Firstly, it is important to say that nobody gives you BTC for free because the price is too high. But there are several ways to get free parts of BTC. These include using a crypto credit card, playing free games, using a browser extension, taking surveys, completing tasks on websites, learning about Bitcoin from websites like Binance Academy, using a Crypto Browser such as CryptoTab, using a cashback crypto credit card, participating in Bitcoin faucets, Bitcoin interest accounts, and in referral programs.

Blockchain projects utilize airdrops to give out free crypto tokens to their communities in an effort to boost adoption. Here are the best Bitcoin Airdrops:

- Super Bitcoin

- Bitcoin Cash

- Bitcoin Gold

- Bitcoin Private

For up-to-date information you can check here: https://airdrops.io/bitcoin-holders/

BTC Price History

Yesterday BTC price was 115 152.93 $. For 24 hours it increased for 1.23%

A week ago BTC price was 111 258.99 $. For 7 days it increased for 4.78%

A month ago BTC price was 117 754.49 $. For 30 days it decreased for 1.00%

A year ago BTC price was 57 967.10 $. For 365 days it increased for 101.10%

Сколько BTC стоил в 2025?

В 2025 году максимальная цена BTC составила 124 293.14 $, минимальмальная цена – 74 557.60 $, средняя цена – 101 627.65 $. В начале года BTC стоил 93 423.02 $, а в конце года – 116 599.47 $. За весь 2025 год цена BTC increased на 24.81%.

Сколько BTC стоил в 2024?

В 2024 году максимальная цена BTC составила 108 112.92 $, минимальмальная цена – 38 593.22 $, средняя цена – 65 920.45 $. В начале года BTC стоил 42 443.17 $, а в конце года – 93 502.01 $. За весь 2024 год цена BTC increased на 120.30%.

Сколько BTC стоил в 2023?

В 2023 году максимальная цена BTC составила 44 627.80 $, минимальмальная цена – 16 505.40 $, средняя цена – 28 815.57 $. В начале года BTC стоил 16 534.59 $, а в конце года – 42 390.12 $. За весь 2023 год цена BTC increased на 156.37%.

Сколько BTC стоил в 2022?

В 2022 году максимальная цена BTC составила 47 737.92 $, минимальмальная цена – 15 549.55 $, средняя цена – 19 827.49 $. В начале года BTC стоил 46 187.33 $, а в конце года – 16 536.50 $. За весь 2022 год цена BTC decreased на 64.20%.

Сколько BTC стоил в 2021?

В 2021 году максимальная цена BTC составила 67 562.35 $, минимальмальная цена – 28 963.12 $, средняя цена – 47 365.53 $. В начале года BTC стоил 28 963.12 $, а в конце года – 46 187.33 $. За весь 2021 год цена BTC increased на 59.47%.

Сколько BTC стоил в 2020?

В 2020 году максимальная цена BTC составила 28 963.12 $, минимальмальная цена – 4 845.52 $, средняя цена – 11 098.21 $. В начале года BTC стоил 7 168.26 $, а в конце года – 28 963.12 $. За весь 2020 год цена BTC increased на 304.05%.

Сколько BTC стоил в 2019?

В 2019 году максимальная цена BTC составила 12 897.89 $, минимальмальная цена – 3 363.76 $, средняя цена – 7 365.85 $. В начале года BTC стоил 3 709.84 $, а в конце года – 7 168.26 $. За весь 2019 год цена BTC increased на 93.22%.

Сколько BTC стоил в 2018?

В 2018 году максимальная цена BTC составила 17 187.77 $, минимальмальная цена – 3 207.60 $, средняя цена – 7 533.42 $. В начале года BTC стоил 13 859.40 $, а в конце года – 3 709.84 $. За весь 2018 год цена BTC decreased на 73.23%.

Сколько BTC стоил в 2017?

В 2017 году максимальная цена BTC составила 19 404.84 $, минимальмальная цена – 780.54 $, средняя цена – 3 972.23 $. В начале года BTC стоил 967.68 $, а в конце года – 13 859.40 $. За весь 2017 год цена BTC increased на 1 332.23%.

Сколько BTC стоил в 2016?

В 2016 году максимальная цена BTC составила 980.24 $, минимальмальная цена – 358.67 $, средняя цена – 567.57 $. В начале года BTC стоил 430.21 $, а в конце года – 967.68 $. За весь 2016 год цена BTC increased на 124.93%.

Сколько BTC стоил в 2015?

В 2015 году максимальная цена BTC составила 466.24 $, минимальмальная цена – 178.17 $, средняя цена – 272.92 $. В начале года BTC стоил 321.87 $, а в конце года – 430.21 $. За весь 2015 год цена BTC increased на 33.66%.

Сколько BTC стоил в 2014?

В 2014 году максимальная цена BTC составила 915.76 $, минимальмальная цена – 310.94 $, средняя цена – 526.09 $. В начале года BTC стоил 732.00 $, а в конце года – 321.87 $. За весь 2014 год цена BTC decreased на 56.03%.

Сколько BTC стоил в 2013?

В 2013 году максимальная цена BTC составила 1 135.00 $, минимальмальная цена – 13.28 $, средняя цена – 188.24 $. В начале года BTC стоил 13.51 $, а в конце года – 732.00 $. За весь 2013 год цена BTC increased на 5 318.20%.

Сколько BTC стоил в 2012?

В 2012 году максимальная цена BTC составила 13.71 $, минимальмальная цена – 4.22 $, средняя цена – 8.29 $. В начале года BTC стоил 4.70 $, а в конце года – 13.51 $. За весь 2012 год цена BTC increased на 187.39%.

Сколько BTC стоил в 2011?

В 2011 году максимальная цена BTC составила 29.91 $, минимальмальная цена – 0.29 $, средняя цена – 5.41 $. В начале года BTC стоил 0.29 $, а в конце года – 4.70 $. За весь 2011 год цена BTC increased на 1 509.89%.

Сколько BTC стоил в 2010?

В 2010 году максимальная цена BTC составила 0.47 $, минимальмальная цена – 0.05 $, средняя цена – 0.14 $. В начале года BTC стоил 0.05 $, а в конце года – 0.29 $. За весь 2010 год цена BTC increased на 489.78%.

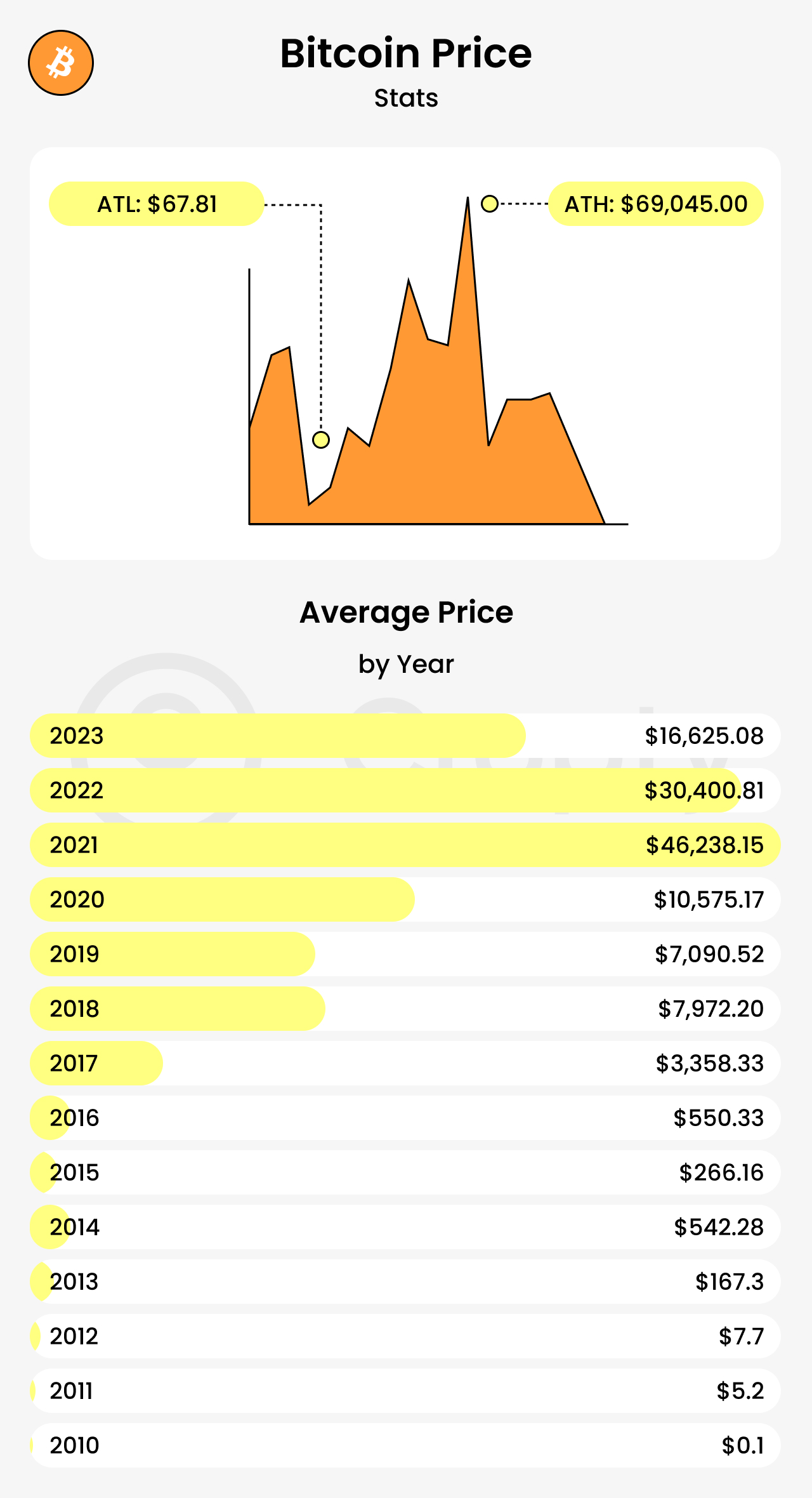

BTC ATH was in November 10th 2021 and the price was $69,045.00.

BTC ATL was in July 6th 2013 and the price was $67.81.

In the early years, the adoption of BTC grew gradually. The pricing history for Bitcoin on CoinMarketCap only goes as far back as April 29, 2013. There was virtually little infrastructure in place during the early years, and the majority of BTC transactions were made by amateurs. The first “real world” transaction occurred in May 2010 and resulted in the purchase of two pizzas for 10,000 Bitcoins. Before February 2011, Bitcoin wasn’t even worth a dollar.

The fireworks started at that point. The cost of Bitcoin had increased 30 times by June 2011. The increase didn’t last long, and Bitcoin fell as a sign of what was to come.

In 2013, the price trend of Bitcoin started to alter. The price increased as adoption rose. Starting at $13.28 in 2013 and rising to $230 on April 8. It reached a peak of $1,237.55 in December before plummeting to $687.02 three days later.

By the end of 2014, exchanges had processed 70% of all Bitcoin transactions and had begun bringing on new customers. As a result, crypto became more widely available. 2014 saw a decline in the price of Bitcoin, which peaked at $315.21 at the beginning of 2015.

The asset attracted more investors the next year as rising media attention started to interest the typical retail consumer. Price barriers were easily dismantled. Bitcoin’s price in 2017 fluctuated about $1,000 before breaking $2,000 in mid-May. It then soared to $19,345.49 on December 15.

In 2018 and 2019, the price of Bitcoin fluctuated in short bursts. For instance, the price increased and the trading volume increased in June 2019, when the price reached $10,000. By mid-December, it had dropped to $6,635.84, though.

In 2020, the COVID-19 pandemic caused the economy to collapse. The price of Bitcoin erupted once more. At the beginning of the year, Bitcoin was worth $6,965.72. Bitcoin’s growth was exacerbated by the pandemic shutdown and the ensuing government initiatives that fueled investors’ concerns about the state of the world economy.

By exceeding $40,000 on January 7, 2021, Bitcoin broke its previous price record set in 2020 in less than a month. Mid-April saw fresh all-time highs for Bitcoin prices of more than $60,000. Prices fell by 50% by the summer of 2021, reaching $29,796 on July 19. Another bull run occurred in September, pushing prices as high as $52,693 until a significant decline brought it to a closing price of $40,710 roughly two weeks later.

Bitcoin again hit a record high on November 10, 2021, rising to $68,789 before falling to $64,995. Bitcoin’s closing prices barely reached $47,445 by the end of March before dropping even more to $28,305 on May 11 during the period from January to May 2022. Since July 2021, Bitcoin had not closed below $30,000 until today. Cryptocurrency prices fell on June 13. For the first time since December 2020, the price of Bitcoin fell below $23,000.

By the end of 2022, Bitcoin had plunged below $20,000 since the “crypto winter” started in November 2021.

How Much Is BTC Today?

Today Bitcoin (BTC) has a price $21,632.66. This is lower in the last 24 hours on 1,20%.

BTC Price Prediction

What Will Be the BTC Price Tomorrow?

Bitcoin is expected to rise by 1.45% and reach $ 24,130 by tomorrow.

What Will Be the BTC Price in a Week?

Bitcoin prices are expected to remain volatile in the upcoming week, with analysts predicting a range of $23,686 to $27,056.

What Will Be the BTC Price in a Month?

According to the experts, the Bitcoin price is expected to remain relatively stable for the next month. However, as with any asset, its value can change quickly due to a variety of factors, such as news, regulations, and other external events. Based on the analysis of the costs of Bitcoin by crypto experts, the maximum and minimum BTC prices expected in the next month are $194,782.26 and $153,206.86 respectively.

What Will Be the BTC Price in a Year?

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2024, the minimum price of Bitcoin will be around $50,160.45. The maximum expected BTC price may be around $58,939.41. On average, the trading price might be $51,930.58 in 2024.

What Will Be the BTC Price in 5 Years?

Bitcoin’s volatility is likely to continue in the next 5 years, and the fifth halving event, which is set to take place in 2028, could also shape the Bitcoin price prediction in 5 years.

What Will Be the BTC Price in 10 Years?

The future of Bitcoin is uncertain, but many analysts are predicting that it could reach as high as $100,000 or even $200,000 in the next 10 years.

What Will Be the BTC Price in 2024?

The average price of Bitcoin for April 2024 should range between $29259.90 to $33664.62. This likely reflects the upcoming halving event that is expected to take place in 2024, cutting the Bitcoin miner’s reward to 3.125 BTC per block. This could influence the demand and supply of Bitcoin, leading to a surge or decline in its price. Therefore, predicting the exact price of Bitcoin in 2024 is a difficult task.

What Will Be the BTC Price in 2025?

According to technical analysis by cryptocurrency experts, Bitcoin’s (BTC) price is expected to reach $81,008.00 by 2025.

What Will Be the BTC Price in 2026?

The BTC price is predicted to reach a maximum level of $114,866.65 and a minimum of $95,446.02 in 2026.

What Will Be the BTC Price in 2027?

According to the Bitcoin price forecast for December 2027, the average price of Bitcoin (BTC) might reach $83,459.43 by the end of the month.

What Will Be the BTC Price in 2028?

According to crypto analysis, Bitcoin’s average price in August 2028 is expected to reach a maximum of $120,709.43, and a minimum of $111,827.35.

What Will Be the BTC Price in 2029?

The highest possible price for Bitcoin according to the prediction is $165,140.28, and this does not take into account the potential for Bitcoin’s price to vary significantly from this average.

What Will Be the BTC Price in 2030?

Some have predicted that the price of Bitcoin could reach as high as $500,000 by 2030, while others are more conservative and believe that it will settle in the $100,000–$200,000 range.

What Will Be the BTC Price in 2035?

According to the predictions of Telegaon, Bitcoin could be trading at $175,109.22 in 2030.

What Will Be the BTC Price in 2040?

Bitcoin’s price is expected to continue rising in the future, with analysts predicting that it could reach as high as $418,512.87 by 2040.

What Will Be the BTC Price in 2050?

A recent report from CoinDesk suggests that the average price prediction for Bitcoin in 2050 is $511,000.

Can the BTC Price Reach $100,000?

The price will possibly be $100,000 by 2025.

Bitcoin could reach $100,000 by 2025, according to Bloomberg Commodity Strategist Mike McGlone, assuming the current bear market ends and cryptocurrency prices start to rise once again. Bitcoin is anticipated to reach at least $100,000 by 2025, according to a panel of more than 50 cryptocurrency experts assembled by Finder.

“It’s just a question of time”, McGlone remarked in a June interview with Kitco News, “That’s purely measuring, supply by code is going down, demand and adoption are going up.”

Can the BTC Price Reach $200,000?

The price will possibly be $200,000 by the spring of 2027.

Greg Beard, one of the most successful natural resource investors, picks Bitcoin as a gusher for the ages:

“It’s hard to know where Bitcoin’s price will be at, say, the end of the year,” he told Fortune in a phone interview from a family ski vacation in France. “But if you’re a fundamental-style investor that believes in Bitcoin as a store of value, it should be worth multiples of today’s price in five years, I’d say at least five times.” If he’s right, the lead cryptocurrency would be selling for at least $200,000 by the spring of 2027. Beard sees momentum building rapidly as folks and funds increasingly believe that Bitcoin’s the ideal fortress for protection against an inflation-ravaged dollar. “The better Bitcoin does, the more interest it will generate,” he says. “We’ll see a compounding effect.”

Can the BTC Price Reach $500,000?

The price will possibly be $500,000 by 2028.

It is almost unthinkable that Bitcoin will ever reach $500,000 based on quick calculations. The global economy would need to be completely reset, Bitcoin would have to become the world’s reserve currency, and digital gold would have to take the place of actual gold. What do Bitcoin-related people think about it?

During his speech at the Bloomberg Crypto Summit, Novogratz, the CEO of crypto investment firm Galaxy Digital, stated that one BTC will be worth half a million dollars in five years. The billionaire cites the rising usage and exceptional attributes of cryptocurrency as the cause.

By the end of the decade, according to Anthony Pompliano, co-founder and partner of Morgan Creek Digital Assets, bitcoin might reach $500,000. He continued without providing a timeframe that it would someday reach $1 million per coin.

“I think that bitcoin will eventually rise to become the global reserve currency. I think bitcoin will eventually be much much larger than the gold market cap,” he said during the latest episode of CNBC’s “Beyond the Valley” podcast.

On February 13, 2023, Robert Kiyosaki made a twit:

“Giant crash coming. Depression possible. Fed forced to print billions in fake money. By 2025 gold at $5,000 silver at $500 and Bitcoin at $500,000. Why? Because faith in US dollar, fake money, will be destroyed. Gold & Silver Gods money. Bitcoin people’s $. Take care.“

Why Is BTC Price Down Today?

By the end of 2022, Bitcoin, which began the last year on a high note, might have reached its pinnacle once more, but a series of terrible occurrences caused too many price fluctuations, causing BTC to fall from $50,000 levels to $15,000 levels during the course of the previous year.

Recent price changes in Bitcoin and the crypto market as a whole have been brought on by weak macroeconomic headwinds and recent crypto industry bankruptcies. Several factors have caused Bitcoin to decline, including:

- Russia-Ukraine war.

- Rising inflationary fears which means more expenses on cost of living.

- Uncertainty due to rising interest rates in the U.S. and the U.K.

- China making cryptocurrency transactions illegal.

- New tax regime system in India.

- Terra-Luna crash.

- Lastly, the collapse of the largest global cryptocurrency exchange FTX.

While some analysts think that the current price of Bitcoin gives a once-in-a-generation opportunity to buy, others think that the price weakening at the $22,500 level of BTC is a reflection of its strong link to the U.S. dollar index (DXY) and equities.

The market’s general anticipation that major technology companies like Microsoft, Alphabet, Salesforce, and Tesla will post weak earnings is causing a reaction in the price of bitcoin. Microsoft’s decline on January 25 reached 4%, while the other companies only lost up to 3%.

As ETH traders become slightly pessimistic, Ethereum’s $1.5K support reduces.

According to ETH derivatives data, bulls are growing less likely to support the present price level, opening the door for further price declines.

Bitcoin (BTC) News

Bitcoin price has increased by 40.6% since January 1, when it hit a year low of $16,496.

The UK Bitcoin community responds to the introduction of the digital pound and the CBDC. The United Kingdom will “examine the case for a digital pound” with the aid of a new position called “head of CBDC,” however U.K. Bitcoiners contend it may not be necessary.

Fed’s threat to Bitcoin in 2023 is “serious,” according to Lyn Alden. With U.S. liquidity circumstances in control, the price rebound of Bitcoin this year is not without its challenges. In 2023, the “great threat” of Bitcoin remains since macroeconomic factors will determine how the price will move. According to economist Lyn Alden, who expressed skepticism about Bitcoin’s continued bullishness after its advances in January.

This East African nation benefits from bitcoin mining in more ways than one. In a distant area of Malawi, a landlocked nation in southeast Africa, a Bitcoin mining operation connects more families to the grid while bringing economic empowerment to a destitute area.

A “generational purchasing opportunity” for Bitcoin is suggested by six on-chain measures. Six well-proven on-chain measures are showing patterns that were last seen at the bottom of the previous three bear markets.

How to Buy Bitcoin?

- Create a free account on the exchange website or the app.

- Click on the “Buy Crypto” link, which will show the available options in your country. Choose Bitcoin (BTC).

- Choose how you want to buy the Bitcoin (BTC) asset: with a credit or debit card, bank deposit or with the help of third party payment.

- Complete the transaction.

Where to Buy Bitcoin?

You can buy Bitcoin on well-known exchanges such as Binance, Coinbase, Kraken, KuCoin, Bitstamp, Bitfinex, OKX, Bybit, Gate.io, Binance.US and others. Here are the best places to buy BTC by Cropty.com:

Binance

Coinbase

Kraken

KuCoin

Bitstamp

Bitfinex

OKX

Bybit

Gate.io

Binance.US

Is It Possible to Buy BTC on Coinbase?

Yes, you can buy BTC on Coinbase, BTC price on Coinbase is $21,628.62. You can also buy BTC token on other exchanges. You can also trade and exchange BTC for other tokens on Coinbase.

How to Buy BTC on Coinbase?

- Sign in to Coinbase.

- Select “Buy / Sell” on the upper right-hand side.

- Click the “Buy” link and select BTC.

- Enter the amount you’d like to buy denominated in crypto or your local currency.

- Select your payment method.

- Click “Preview Buy” to confirm your purchase (you can always click the back arrow to make a change).

- If the details are correct, click “Buy” to complete your purchase.

Is It Possible to Buy BTC on Crypto.com?

Yes, you can buy BTC on Crypto.com, BTC price on Crypto.com is $21,789.03. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Crypto.com.

How to Buy BTC on Crypto.com?

- Create an account on Crypto.com.

- Select “Buy” and then BTC.

- Tap Connect and you will be redirected to link your DeFi Wallet and App accounts.

- Select your preferred blockchain and enter the amount you’d like to purchase.

- Once you’re ready, tap “Next”.

- Review your transaction details and tap “Confirm Purchase”.

- The transaction will proceed and your newly purchased tokens will be automatically deposited into your DeFi Wallet once it is complete.

Is It Possible to Buy BTC on Binance?

Yes, you can buy BTC on Binance, BTC price on Binance is $22,843.80. You can also buy BTC token on other exchanges. You can also trade and exchange BTC for other tokens on Binance.

How to Buy BTC on Binance?

- Log in to your Binance account and click “Buy Now” on the homepage banner.

- Enter the fiat amount you want to spend and the system will automatically display the amount of crypto you can get. Click “Continue”.

- You can choose your preferred payment method here. To buy with a credit/debit card, click “Visa/Mastercard”, then click “Continue”.

- Follow the instructions and enter your card information.

- Your card will be added. Click “Continue”.

- Please check the payment details and fees and confirm your order within 1 minute, or the amount of BTC you can get would be recalculated based on the current market price. You can click “Refresh” to see the new order amount.

- You will be redirected to your bank’s OTP Transaction Page. Follow the on-screen instructions to verify the payment. After that, you can see the purchased crypto in your Binance Spot Wallet instantly.

Is It Possible to Buy BTC on PancakeSwap?

Unfortunately, BTC is not currently traded on PancakeSwap.

Is It Possible to Buy BTC on Kraken?

Yes, you can buy BTC on Kraken, BTC price on Kraken is $21,643.30. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Kraken.

How to Buy BTC on Kraken?

- Create your free Kraken account.

- Connect your card or bank account after Kraken verifies your account.

- Click on “Buy” button.

- Choose BTC and confirm the transaction.

Is It Possible to Buy BTC on KuCoin?

Yes, you can buy BTC on KuCoin, BTC price on KuCoin is $21,635. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on KuCoin.

How to Buy BTC on KuCoin?

- On KuCoin’s homepage, look for the “Sign Up Now” button and click it.

- On the platform, click the “Assets” button.

- Choose the asset that you wish to deposit, or type BTC in the search bar.

- Click the “Deposit” button right beside your chosen asset.

- In the following field, input your wallet address. You can also scan the barcode with a QR scanner.

- KuCoin will show you a screen with tips to do before you confirm your deposit. Make sure to double-check your wallet address first.

- Complete your transaction.

- Once your asset is deposited in your account, navigate to the Markets tab.

- Select your asset from the list, and then click the “Trading” button next to it.

- To buy, fill out the “Buy” field with your preferred amount, and click “Buy”. The process is the same for the “Sell” option.

Is It Possible to Buy BTC on OKX?

Yes, you can buy BTC on OKX, BTC price on OKX is $21,643. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on OKX.

How to Buy BTC on OKX?

- To get started, visit the OKX website and register your own OKX account.

- Upload your identity document for verification.

- Head to “Buy Crypto” and buy Bitcoin with credit cards, Apple Pay, or bank transfer, etc.

- Confirm the transaction.

Is It Possible to Buy BTC on Bitfinex?

Yes, you can buy BTC on Bitfinex, BTC price on Bitfinex is $22,860. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Bitfinex.

How to Buy BTC on Bitfinex?

- Log in to your Bitfinex account or sign up to create one.

- Select Payment Cards on the Deposit page.

- Both payment processors are available for BTC purchase. For OWNR, you will need to get the full or intermediate verification level.

- Select BTC, fill in the amount, and select the destination wallet.

- Agree to the terms and then click Proceed to Payment.

Is It Possible to Buy BTC on Bitstamp?

Yes, you can buy BTC on Bitstamp, BTC price on Bitstamp is $21,644.84. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Bitstamp.

How to Buy BTC on Bitstamp?

- Go to the deposit page and choose card purchase from the side menu.

- Choose BTC to buy.

- Choose which currency you will use to pay.

- Choose how much currency you would like to purchase.

- Enter your card details.

- Confirm your purchase.

Is It Possible to Buy BTC on Bybit?

Yes, you can buy BTC on Bybit, BTC price on Bybit is $21,689.00. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Bybit.

How to Buy BTC on Bybit?

- Register and verify your account, or log in to your Bybit account.

- Tap on “Buy Crypto” button on the menu, select “Express” from the drop-down menu.

- Enter the desired amount of BTC to be purchased from your preferred fiat currency.

*Note that some of these payment providers may not be available to you, due to geographical constraints.

- Proceed with payment upon selecting your preferred funding method.

- Verify your account via the KYC process to complete your purchase.

Is It Possible to Buy BTC on Bitget?

Yes, you can buy BTC on Bitget, BTC price on Bitget is $21,613.82. You can also buy BTC tokens on other exchanges. You can also trade and exchange BTC for other tokens on Bitget.

How to Buy BTC on Bitget?

- Choose the fiat currency you want to pay.

- Choose BTC in the field “I’ll get”.

- Choose the payment method.

- Choose the payment provider.

- Click “Next” button.

- Verify your identity.

- Complete the transaction.

Is This a Good Idea to Invest in Bitcoin?

Investing in Bitcoin can be a good idea, depending on your individual objectives and financial situation. Crypto-investments are often seen as risky due to their volatility, but if you are comfortable with the risks and have the necessary funds, Bitcoin can be a great investment to diversify your portfolio.

If you are new to investing, it is strongly recommended that you do your research, assess the risks, and only invest as much as you are comfortable with. Additionally, it’s important to remember that investing in crypto-assets does not require a large sum of money – a small initial investment can be enough to start.

In June 2022, Securities and Exchange Commission Chair Gary Gensler said on CNBC that some cryptocurrencies “have the key attributes of a security” while others, specifically Bitcoin, “are a commodity.”

Still, others say it’s a currency — something you can use to pay for goods and services. While there are businesses that accept Bitcoin, it’s far from being a widespread practice.

Investing in Bitcoin

There are several methods of investing in Bitcoin:

- Purchase Bitcoin directly on exchanges.

- Invest in Bitcoin-related companies.

- Invest in Bitcoin-focused funds.

- Become a Bitcoin miner.

How to Buy BTC in the USA?

You can buy BTC in the USA on the next exchanges:

- Coinbase

- Binance US

- CEX.io

- Gemini

- Kraken

New York State is frequently referred to be the financial hub of the United States and, possibly, the entire world, with its epicenter being New York City and Wall Street. At the end of 2019, the assets under the supervision and regulation of the New York State Department of Financial Services (NYDFS) were estimated to be $7.3 trillion. Nearly six years after the creation of Bitcoin, the NYDFS became aware of cryptocurrency enterprises and in 2015 established a crypto law known as the “BitLicense.” There was also the option of a Limited Purpose Trust Charter for individuals seeking even more fiduciary authority.

Beginning in 2013, the NYDFS started to receive requests for money transmitter licenses from cryptocurrency businesses, putting the sector on its radar. Benjamin Lawsky, a former NYDFS superintendent, revealed a suggested regulatory framework for bitcoin enterprises in July 2014. As long as they provided services to residents of New York State, businesses located anywhere in the world would be subject to the crypto legislation. The industry and the department began talking about potential regulation of bitcoin (and more broadly, cryptocurrencies) after this declaration.

In June 2015, approval under the BitLicense or Limited Purpose Trust became a requirement for cryptocurrency businesses engaged in the following activities:

- Transmitting virtual currency

- Storing or custody virtual currency

- Buying and selling virtual currency, including exchanging virtual currencies for fiat currencies

- Operating a virtual currency trading exchange

- Issuing virtual currency

Under New York crypto regulations, there are a number of requirements that companies must comply with on an ongoing basis, including consumer protection, cybersecurity, Know Your Customer (KYC), and Anti-Money Laundering (AML) rules.

In addition to those requirements, only “greenlisted,” pre-approved cryptocurrencies are covered under the BitLicense or Limited Purpose Trust. The breakdown of those coins (as of Q4 2020) is:

- Cryptocurrencies approved for listing:

- Binance USD (BUSD)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Gemini Dollar (GUSD)

- Litecoin (LTC)

- Pax Gold (PAXG)

- Paxos Standard (PAX)

- Cryptocurrencies approved for custody:

- All cryptocurrencies approved for listing (above)

- Ethereum Classic (ETC)

- Ripple (XRP)

How to Get BTC in Polygon?

If you want to get BTC in Polygon firstly you need to swap BTC to MATIC. For example, with service ChangeNOW, BTC to MATIC conversions are simple, transparent, and you don’t even need to register.

So, to convert 1 Bitcoin to MATIC with service ChangeNOW you should follow the next steps:

- Choose the exchange pair: Bitcoin vs Polygon.

- Enter the address of the recipient to process the Bitcoin-Polygon transaction.

- Check the rate: how many BTC in Polygon you’ll receive.

- Confirm the transaction, make the deposit, and you’ve converted 1 Bitcoin to Polygon.

How to Swap BTC to BNB in Trust Wallet?

On Trust Wallet, it is not possible to convert BTC to BNB directly. This is due to the fact that swapping is only possible inside the same network.

Although Trust Wallet does handle multi-chain transactions, you will run against fundamental limits when it comes to personalized swapping, therefore you will need to look elsewhere.

So, to make swapping follow the next steps:

- Set up your Binance account. Binance is a centralized exchange as opposed to Trust Wallet. You must finish the identity verification process before you can trade BTC, buy cryptocurrencies, or withdraw fiat money.

- Send BTC from Trust Wallet to Binance. Find your Binance Bitcoin address, enter it into your Trust Wallet, and then transmit the money.

- Use Binance Convert. You must use Binance Convert on your account and the BTC-BNB trading pair after receiving your Bitcoin from Binance. Please be aware that there will be fees associated with this transaction.

- Send BNB from Binance to Your Trust Wallet. Choose your BNB address under “receiving” and paste it into Binance. After that, you’ll be able to send the money. The most efficient method for it is to use Binance as an alternative since you cannot directly swap the two tokens in Trust Wallet.

How to Convert BTC into USDT?

To convert BTC into USDT follow this instruction:

- Transfer your BTC to an exchange that supports both BTC and USDT.

- Log in to your account on the exchange and locate the trading pair for BTC/USDT.

- Select the amount of BTC you wish to convert to USDT.

- Confirm the details of the transaction and execute the trade.

- Your account should now be credited with the corresponding amount of USDT.

Buy BTC with PayPal

To buy BTC with PayPal follow the next steps:

- Sign up for an account or sign in to your PayPal account.

- In the line cryptocurrency select Bitcoin.

- Select “Buy” and enter the amount of Bitcoin you want to get.

- Select the payment method and click on “Buy” button.

Buy BTC with Credit Card

To buy Bitcoin with a credit card follow the next steps:

- Visit a cryptocurrency exchange.

- Create an account.

- Verify your identity.

- Select the amount of Bitcoin you want to buy.

- Enter your credit card information.

- Confirm the transaction.

Buy BTC with Debit Card

To buy Bitcoin with a debit card follow the next steps:

- Visit a cryptocurrency exchange.

- Create an account.

- Verify your identity.

- Select the amount of Bitcoin you want to buy.

- Enter your debit card information.

- Confirm the transaction.

How to Buy BTC Without Verification?

There are 2 exchanges where you can buy BTC without verification: Bybit and Paxful.

Bitcoin may be purchased with a credit card and without verification at Bybit. Bybit is a well-known and reliable cryptocurrency exchange. Its user-friendly interface makes speedy trading possible. Perpetual contracts are also available for trading with 100x leverage. Bybit’s fiat gateway allows traders and investors to purchase Bitcoin with a credit card. For both novice and seasoned investors, Bybit is a good choice.

Paxful is an online marketplace that connects buyers and sellers. The P2P framework of the exchange allows merchants to opt to maintain their anonymity. Paxful is a good alternative for users because it offers more than 300 payment methods. In addition, Paxful can direct customers to local Bitcoin dealers who will take payment in cash. You can log in and purchase Bitcoin on Paxful using an alias email address without having to provide identification. You need not be concerned about disclosing your name for orders under $1 000 USD. One of the safest places to buy bitcoins with a credit card and no verification is Paxful.

How to Sell BTC in the USA?

The best way to sell BTC in the USA is through a cryptocurrency exchange. Select a suitable trading pair, and place a sell order. Once the order is filled, you will receive the funds in the local currency.

Should I Sell BTC?

Today Bitcoin is one of the best investments for the future because Bitcoin price has fallen and now is the time to buy. Based on the experience of the past years, it is safe to say that Bitcoin will rise in the future and you can increase your finances. Don’t worry if Bitcoin will be falling in value for a while, it is OK because the cryptocurrency market is very volatile. Most importantly, don’t panic and don’t rush to withdraw your assets, but wait for the token to go up again. Even more, it’s better to buy BTC now, while the price is lower than it was a year ago.

What Is a BTC Address?

A Bitcoin address is a special code that acts as a virtual address for sending cryptocurrency. Similar to how fiat money is frequently sent to bank account addresses, anyone can send the cryptocurrency to Bitcoin addresses. The Bitcoin address, on the other hand, is only meant to be used once for a single transaction and is not meant to be permanent. A Bitcoin address cannot store a balance, in contrast to a digital wallet.

There are 26–35 alphanumeric characters in the address itself. An asymmetric key pair’s public key is represented by this string. A Bitcoin address is typically formatted as P2PKH (pay to public key hash). Through cryptographic procedures, digital wallets or Bitcoin clients produce addresses: The public key is then derived from the private key by the software using an asymmetric signature method. The user uses the private key to sign, and the public key is used to confirm that signature.

How to Get a BTC Address?

If you want to get a Bitcoin address, the first thing you need to do is create a Bitcoin wallet. After this, create an account. Once you have created the account, you will be given a Bitcoin address which will be used for both receiving and sending payments. You can generate additional addresses if you need to.

Bitcoin Staking

Unfortunately, Bitcoin Staking is unavailable, because of the proof-of-work model, while staking is available only with cryptocurrencies that use the proof-of-stake model to process payments.

Bitcoin Farming

A large investment is needed to purchase high-quality computers for cryptocurrency mining. Therefore, mining farms are created as a solution to this problem. A Bitcoin farm is a huge area that resembles a warehouse or repository more than anything else. There, computers are kept in a cold environment with air conditioning or central cooling to keep them from overheating and breaking down.

Bitcoin’s essential value is extracted through farming. As a result, the output of these farms will be the upcoming big thing. The farmers, often called to as miners, run their programs on this farm to harvest the digital currencies. The core of the Bitcoin network is made up of these farmers who process these currencies. Without farmers, the network would collapse and eventually become worthless. These farmers help to protect the network and execute each transaction appropriately. By resolving the computational issues, Bitcoin farmers complete their work. As a result, farmers that cooperate and assist in computing solutions win freshly created coins and transaction fees. It is necessary to educate oneself on the mining process if one wants to comprehend this blockchain.

Bitcoin Shorting

The purpose of shorting Bitcoin is to sell it at a high and then repurchase it for a low price. Short sellers adopt this mentality in reverse, aiming to sell high and purchase low, in contrast to the majority of traders who prefer to buy low and sell high. Bitcoin traders benefit from the price change between when they sold the asset and when they bought it again if they are right and the price declines.

The types of Bitcoin shorting:

Trading on Margin

Through a cryptocurrency margin trading platform, shorting Bitcoin is one of the simplest operations possible. This kind of trading is permitted on many exchanges and brokerages, and margin trades let investors “borrow” money from a broker in order to execute a transaction. It’s crucial to keep in mind that margin includes borrowing money or using leverage, which can boost earnings or exacerbate losses. At the current time, a number of Bitcoin exchanges, including Kraken and Binance, provide margin trading.

Futures Market

A futures market exists for Bitcoin, much like other assets. In a futures transaction, a buyer consents to acquire a security in exchange for a contract that details when and how much the security will be sold. When you purchase a futures contract, you are making a wager that the value of the underlying security will increase, guaranteeing that you can later sell it for a profit. Selling a futures contract indicates a negative outlook and a belief that the price of Bitcoin will fall. By acquiring contracts that wager on a lower price for the cryptocurrency, you can short Bitcoin in this situation.

You can short Bitcoin futures at the derivatives trading venue, such as the Chicago Mercantile Exchange (CME). Bitcoin futures can be bought or traded on well-known exchanges like Kraken or BitMEX and at well-known brokerages like eToro and TD Ameritrade.

Trading Binary Options

Traders can short Bitcoin using call and put options. You would execute a put order, perhaps through an escrow provider, if you wanted to short the currency. This means that even if the price of the currency declines in the future, you would still want to be able to sell it at the current rate.

There are various offshore exchanges that offer binary options, but the costs (and hazards) are substantial. You can limit your losses by opting not to sell your put options, which is one advantage binary options trading has over futures trading. Your losses are therefore restricted to the cost of the put options that you purchased. Deribit and OKEx are well-liked exchanges for trading options.

Prediction Markets

Another option to think about is shorting Bitcoin in prediction markets, where bets are placed on how events will turn out. Cryptocurrency prediction markets are comparable to those in traditional markets. Investors are able to design an event and place a bet based on the results.

Therefore, you might forecast that Bitcoin would decrease by a specific amount or percentage, and if someone accepted your wager, you would stand to gain if your prediction came true. Augur, GnosisDAO, and Polymarket are well-known cryptocurrency prediction markets.

Short-Selling Bitcoin Assets

Even though not all investors may be interested in this method, those who do stand to profit if their wager against Bitcoin pricing is successful. Sell your tokens at a price you’re comfortable with, watch for a decline in price, and then repurchase your tokens. Of course, you could lose money or Bitcoin if the price does not change as you anticipate.

Bitcoin CFDs

Bitcoin can be shorted through a contract for difference (CFD) on a trading platform. CFDs are a type of derivative product that allows traders to speculate on the price movements of an asset without actually owning the asset. To short Bitcoin, traders open an account with a broker that offers CFD trading, deposit funds into the account, and then place an order to sell Bitcoin. The order will then be matched with a buyer at the current market price, and the trader will receive the difference between the selling and buying price as their profit or loss.

Making Use of Reverse Exchange-Traded Goods

Exchange-traded instruments with an inverse strategy are wagers on the price drop of the underlying asset. They are comparable to futures contracts and generate returns by combining them with other derivatives. The sole exchange-traded item accessible to Americans is the Short Bitcoin Strategy ETF from ProShares (BITI).

The BetaPro Bitcoin Inverse ETF (BITI) from Canada and the 21Shares Short Bitcoin ETP from the European Union are both available to investors outside of the United States.

Bitcoin Bridge

The most popular bridge is BTC-ETH direct bridge. It helps people to transfer BTC directly to the Ethereum network. To transfer BTC to another ecosystem you need to go to https://www.portalbridge.com/#/transfer and follow the next steps:

- Connect your wallet with the Portal.

- Select tokens to send through the Portal.

- Click the “Next” button.

- Complete the transaction.

Bitcoin Crypto Loans

With a Bitcoin loan, a borrower typically offers up their Bitcoin holdings as collateral, and the lender gives them cash, and charges interest. Are crypto loans safe? The fast answer is yes but only on well-known platforms. To get a crypto loan you will need:

- Select a Lending Platform.

- Create an Account.

- Select a Bitcoin Loan Type.

- Receive and Accept Bitcoin Loan Offers.

Well-known crypto lending platforms and an average level of annual percentage rate:

| Lending Platform | ARP |

| Crypto.com | 12% |

| YouHodler | 11-14% |

| CoinLoan | 11.95% |

| Binance | Variable |

| Nexo | 12% |

| AQRU | 12.5% |

| Cropty | 9% |

BTC Supported Wallets

Coinbase Wallet Web3

Here you can find a lot of possibilities: trading, exchanging, steaking, giving and receiving credit. The wallet supports hundreds of thousands of tokens. Available in more than 170 countries in 25 languages.

SafePal Crypto Wallet

SafePal Crypto Wallet is secure, decentralized, easy-to-use and free application to manage more than 10,000 crypto. With the SafePal wallet you can store, send, receive, buy and trade crypto at ease, with smooth and intuitive user experience.

Crypto.com DeFi Wallet

It offers you a simple and secure way to explore DeFi projects. Deposit and earn the best returns.

Cropty Wallet

Cropty is a brand new crypto wallet that helps you to store, send and receive your crypto easily. The Cropty wallet supports both EVM and non-EVM chains. The wallet app available for iOS, Android mobile phones and any browser.

How to Add BTC to MetaMask?

You cannot add BTC to your MetaMask wallet because the Bitcoin network is not an Ethereum Virtual Machine (EVM) compliant blockchain that enables smart contracts. Only networks that employ this programming language, including Polygon, BNB Chain, Avalanche, Optimism, and Arbitrum, are supported by MetaMask.

Since the Bitcoin Network is incompatible with Metamask, you are unable to add native Bitcoin (BTC) to your Metamask wallet. However, there are some alternatives you should take into account if you wish to hold some BTC on your Metamask wallet.

The first option is adding Binance-PEG Bitcoin (BTCB) to your Metamask wallet and then sending BTC via the Binance Smart Chain (BEP20) network from an exchange, such as Binance to your Metamask wallet.

Another option to add Bitcoin to your Metamask wallet is to use the right contract address to add the Wrapped Bitcoin (WBTC) token that is now running on Ethereum to your Metamask wallet.

Wrapped Bitcoin (WBTC) and Binance-Pegged Bitcoin Token (BTCB) are an ERC-20 token that delivers the power of Bitcoin on the Ethereum network. They are both essentially just a version of Bitcoin that is used on the Ethereum network. As a result, 1 WBTC and 1 BTCB are equivalent to 1 BTC, and they all have the same value.

How to Buy BTC on Exodus?

There are 2 ways to buy BTC on Exodus: using Ramp and using MoonPay.

To buy BTC on Exodus using Ramp follow the next steps:

- Click on ‘’Buy & Sell Crypto’’ icon in Exodus Mobile.

- Click on ‘’Buy Crypto’’.

- Select the payment method you want.

- Choose the currency you want to use.

- Enter the amount you would like to purchase.

- Select BTC in cryptocurrency field.

- Choose your desired payment provider (if available) and then click on “Continue”.

- Your default web browser will open a page with your order. Click on ‘’Proceed’’.

- Enter your email address, click on the box ‘’agree to the Terms of Service’’, then click on ‘’Proceed’’.

- On the ‘’Enter your wallet address screen’’, the address for the cryptocurrency you’re purchasing should automatically populate from your Exodus wallet. Confirm that the address is correct and then click on ‘’Proceed’’.

- Select the ‘’Card payment method’’, then click on ‘’Proceed’’.

- Enter your billing information and then tap ‘’Save Billing Address’’.

- Enter your card details and then tap ‘’Add Card’’.

- Review your order details on the ‘’Order summary’’ screen. Make sure the amount, your BTC address, and your payment method are correct. When ready, click on ‘’Buy Now’’.

- You will then be prompted to verify your identity. All customers regardless of the amount spent are required to provide basic identifying information, including full legal name. Tap ‘’Verify with ID’’ to continue.

- You will be prompted to continue the verification on your phone. Scan the QR code to continue.

- Click on “Start”.

- Be sure you are in a well-lit area and have your passport, national ID card, or driver’s license at the ready in case you need to undergo verification. To accept the terms and conditions, check the box, then select ‘’Continue’’.

- After finishing, you’ll see the ‘’Complete your transaction’’ screen, which will let you know that the verification process is over. To finish placing your order, tap ‘’Complete payment’’.

- There it is! Depending on network traffic, it should typically take 5 to 20 minutes for your Bitcoin to arrive.

To buy BTC on Exodus using MoonPay follow the next steps:

- Click on ‘’Buy & Sell Crypto’’ icon in Exodus Mobile.

- Click on ‘’Buy Crypto’’.

- Select the payment method you want.

- Choose the currency you want to use.

- Enter the amount you would like to purchase.

- Select BTC in cryptocurrency field.

- Enter your email address and click on “Continue”.

- Enter the verification code sent to your email, check the box “to agree to MoonPay’s Terms of Use and Privacy Policy”, click on “Continue”.

- Enter your name, date of birth, and nationality, click on “Continue”.

- Enter your cellphone number, click on “Continue”.

- After that, a request to confirm your identity will be issued. No matter how much you have spent, all consumers must go through the verification process. Position yourself in decent lighting and be prepared with your passport, national ID card, or driver’s license for verification. Click “Continue” when you’re ready. Once complete, you’ll reach a screen informing you that your verification is in progress.

- When the verification process has been completed, you will receive an email with the subject line “Your identity has been verified”. To continue, click “Complete transaction”.

- Confirm your billing details, enter your card information and click “Continue”.

- Review your order details. To see the breakdown of your fees, click on the “Summary dropdown arrow”.

- Check the box to agree to the “Terms of Use”

- Click “Buy now”.

- There it is! Depending on network traffic, it should typically take 5 to 20 minutes for your Bitcoin to arrive.

How to Buy BTC on Cash App?

In order to buy bitcoin with your Cash App follow this guide:

- On the home screen of the Cash App, select the Bitcoin tab

- Click “Buy BTC”

- To enter a custom quantity, select an amount and confirm

- Fill in your PIN and choose “Confirm”

- You need to have money in your Cash App balance in order to buy Bitcoin.

Not an individual investment recommendation.